The infamous trial has been part if the trials calendar since 1908 and is one of the toughest events of the year

For classic trials regulars, Spring means it’s time to dust off the competition car and head down to Cornwall for the Land’s End Trial.

Originally the London to Land’s End Reliability Trial, this 24-hour motorsport event challenges some 300 competitors and their vehicles across more than 200 miles and up 20 hills.

The aim? To win a gold medal by reaching every summit.

It’s one of three classic trials run by Britain’s oldest motorsport club, the MCC, along with the Exeter Trial in January and the Edinburgh Trial in September (actually held in the Peak District, confusingly).

Autocar reported on the Land’s End Trial from the first running in 1908 but didn’t follow the event from start to finish until 1921.

There was controversy before that particular trial even began, when the MCC introduced a rule that cars with no more than 12hp had to complete the infamously steep Porlock Hill in Somerset at an average speed not below 18mph.

Enjoy full access to the complete Autocar archive at the magazineshop.com

Such was the clamour around the new rule that many headed to the steep climb beforehand to see if this was even possible. “In [our] opinion, the MCC have framed a regulation which is certainly needlessly severe and may possibly prove dangerous,†we said.

Our coverage brought a rush of entries: “The Autocar first drew attention to the difficulty of the trial and more entries had to be dealt with, a testimony to the sporting spirit of the British small car owner.â€

Fifty-eight cars (Rovers, Morrises, Rileys, ACs, various obscurities) of the 64 entered lined up at Cranford Bridge (today close to Heathrow airport) to set off from half past midnight.

One local resident reacted to the large group of “weirdly clad†men hanging around in the dark by “retiring to her cottage in haste to bolt and bar the doorâ€!

The competitors had to not only cover 314 miles on narrow, usually dirt roads using feeble headlights but also brave challenging weather, with “many devoutly wishing they had carried at least one more coatâ€.

Proceeding through the night, they had to endure an ice-cold mist and could barely see the road ahead.

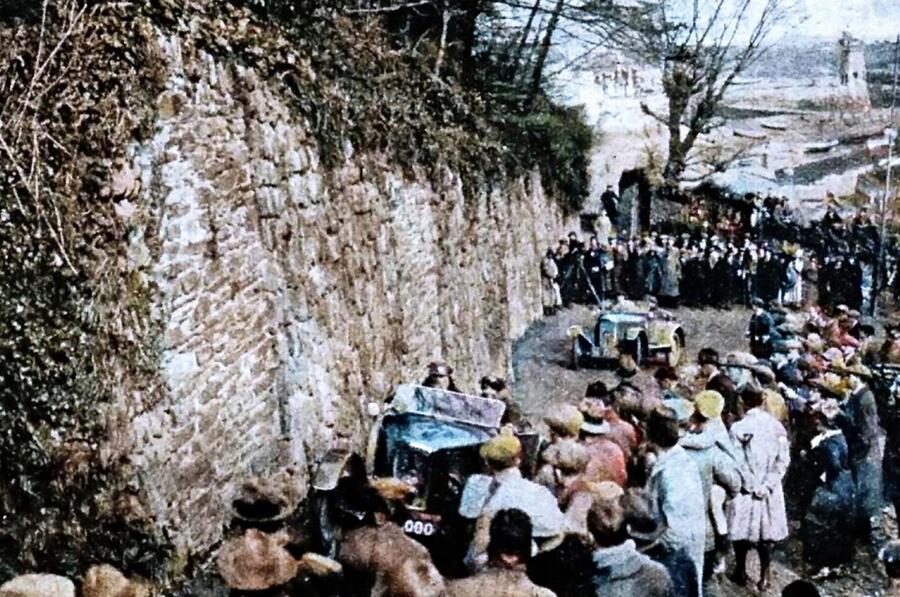

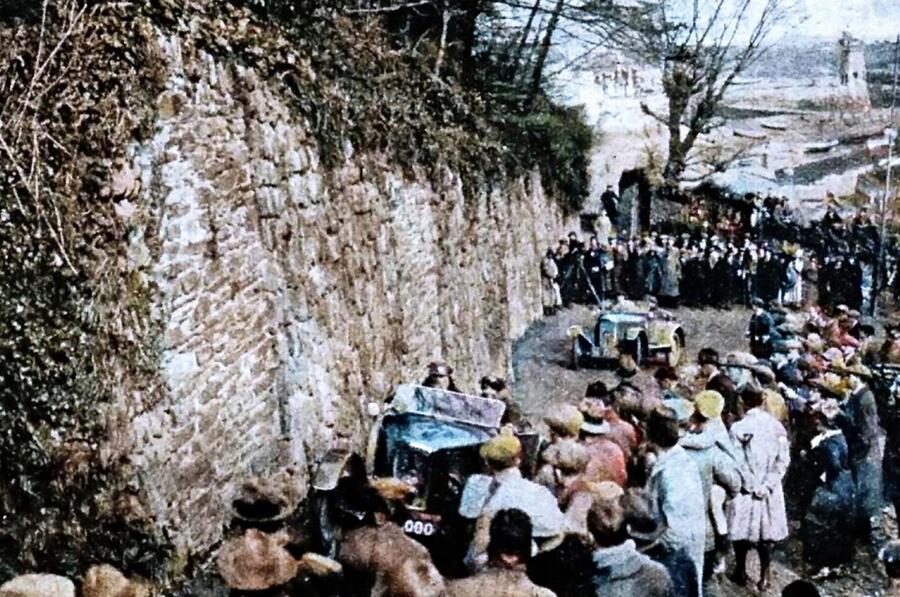

“There can be no doubt that Porlock proves one of the most exacting portions of the trial and on this occasion provided some interesting and exciting results,†we said of the following hill.

Plenty of competitors cleared it, 26 of them at or above the required average speed of 18mph, despite its intimidating gradient and sharp hairpin bends – even a large saloon with six aboard.Â

An even more challenging climb lay ahead: Lynton Hill. Here drivers had to average at least a strenuous 19.4mph, and it certainly delivered on the entertainment front.

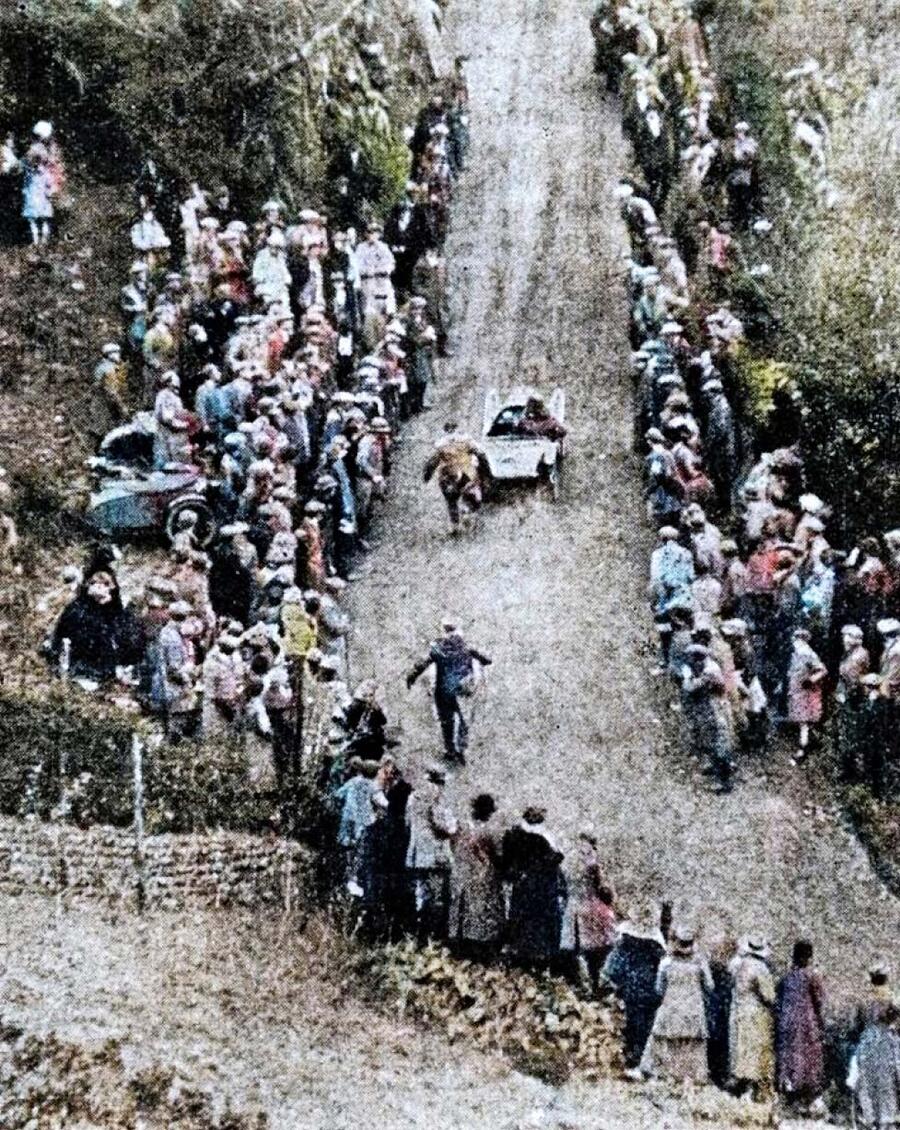

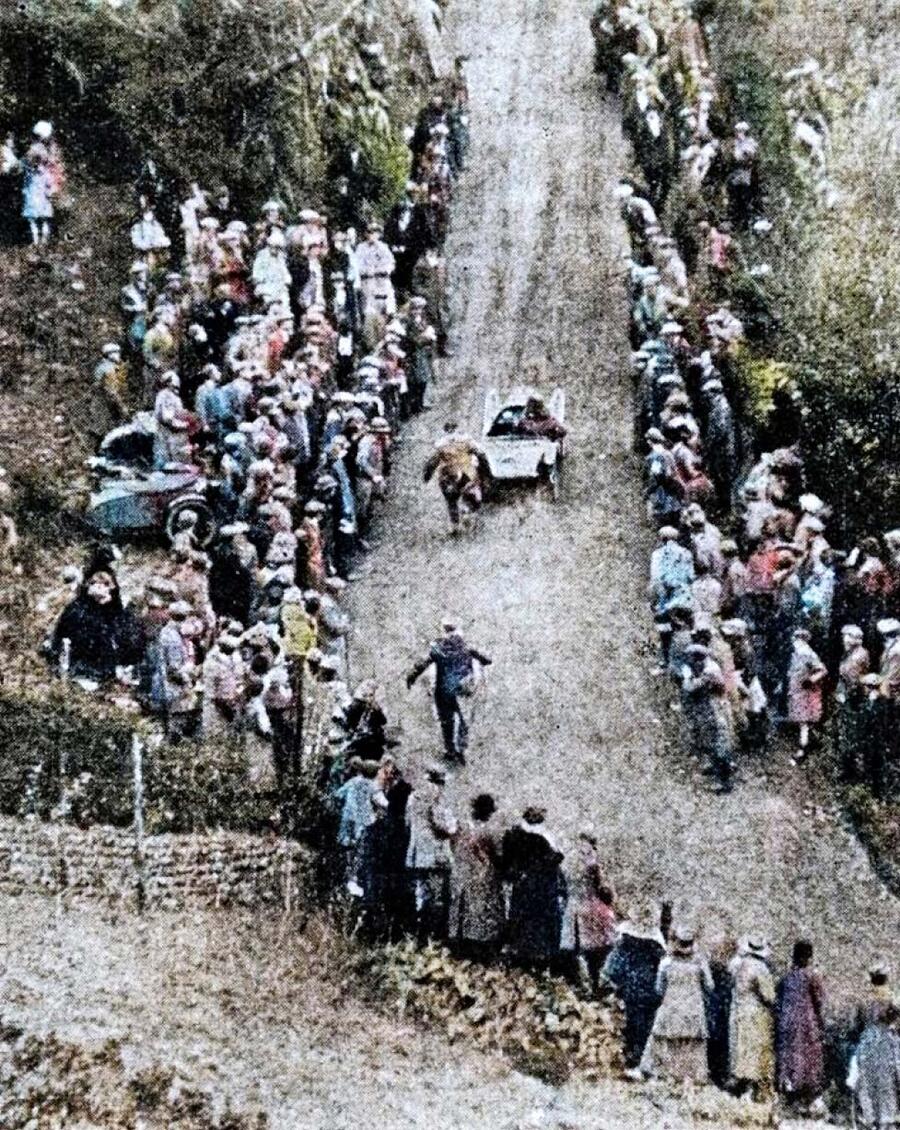

“Tired drivers and mud-spattered cars were eagerly awaited by a considerable crowd which lined the sides,†we said. “The surface was in a very treacherous condition due to rain overnight, and many sidecars had failed due to a lack of adhesion from their single wheels.â€

Indeed, many competitors floundered, but there were several impressive performances too, like that by VG Lloyd, who “astounded everyone with his speed†in his two-cylinder Carden.

Notably, Lionel Martin “romped up the hill†in his new production Aston Martin (he had co-founded the company in 1913 to build hillclimb specials; Aston was a course in Buckinghamshire).

Several had to shed passengers to reach the top, while others fouled the hill by hitting the wall at the hairpin. Some even managed to clear it while avoiding a comrade’s stricken car. One did it on a flat tyre.

From there on to Land’s End, there was little to really concern the drivers.

Forty-two made it to the finish – and we were surprised to see among them HJG Smith’s 10hp Eric-Campbell (a small firm that briefly made cars at the Handley Page aircraft factory in London), as he had broken a tie rod on Porlock so effectively was steering with one wheel. He won a gold medal along with 22 other worthy competitors.

We concluded: “The general consensus of opinion was that a better trial had never been, or one to which more merit was attached to a reward, while, as to sport, no man could wish for better.â€

Since then, more notoriously difficult sections have been added, most famously Beggars Roost (in 1922) and Blue Hills (in 1936), and the Land’s End Trial continues to challenge the best trials drivers and cars.

Long may it continue.