A troubled economy and mandated EV sales are making life difficult for car makers, potentially to your benefit…

Against a backdrop of inflation and a stagnating economy, selling new cars risks resembling a fruit and veg market as dealers rush to slash prices and call out their best deals to anyone within hailing distance.

Compared with this time last year, discounts are larger and offers are more plentiful. As an example of the savings available, Autocar has netted discounts worth a total of £47,123 on popular versions of this year's top 10 best-selling new cars an average of £4712 per vehicle.

The largest discount was £9050 off a new Peugeot 2008 1.2 Puretech Allure, taking its price from £29,540 to £20,490, equivalent to a 30% saving. Meanwhile, the UK's best-selling car, the Ford Puma, was available in 1.0 Ecoboost Hybrid ST-Line form for £24,495, compared with the full on-the-road price of £27,297, a saving of 10.3%.

Away from the top 10, we also bagged a saving of £16,566 on a Ford Mustang Mach-E AWD Extended Range Premium, taking its price from £66,565 to £49,999. Elsewhere, we tracked down a similar cash saving on a fully loaded BMW 550e M Sport Pro xDrive down £16,517 to £74,758.

Of course, the richly specced BMW in particular is something of an outlier and even at its lowest price unlikely to attract much interest. Still, with new cars now so expensive, it and the Mustang Mach-E deal are good examples of the big discounts that can make them more affordable.

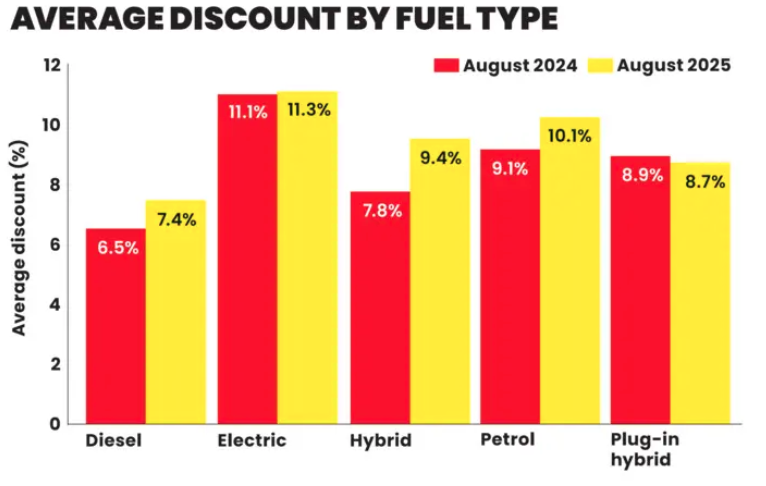

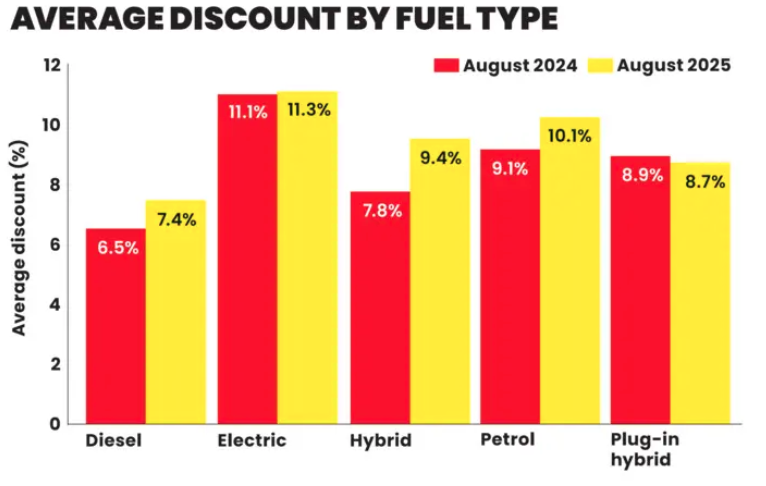

Based on Autotrader figures, in the past 12 months new car discounts have increased across all fuel types (with the exception of plug-in hybrids) by an average of one percentage point to 9.6%. It's only a small rise, but averages mask the peaks and if our survey is anything to go by, this year's range of discounts looks like the Himalayas.

Manufacturers are also putting their shoulder to the wheel with supporting offers. For example, towards the end of August Volkswagen began its Epic Sale, offering £750 off most models in addition to any existing offers and discounts, while Vauxhall offered £500 off all of its models.

"Discounts are as high as they have ever been," says Jonathan Lawless, sales director at Carfile, a car broker. "In particular, there are some very good deals on petrol and diesel models that are ending production. For example, we've been giving a 7.5% discount on Audi Q2 S Line autos with [optional] Technology Packs, plus a further £4750 towards the customer's finance deposit. When ordered before August, there was an additional £500 from Audi too. Ironically, there are also monumental discounts on EVs the cars these outgoing petrol and diesel cars are being replaced by."

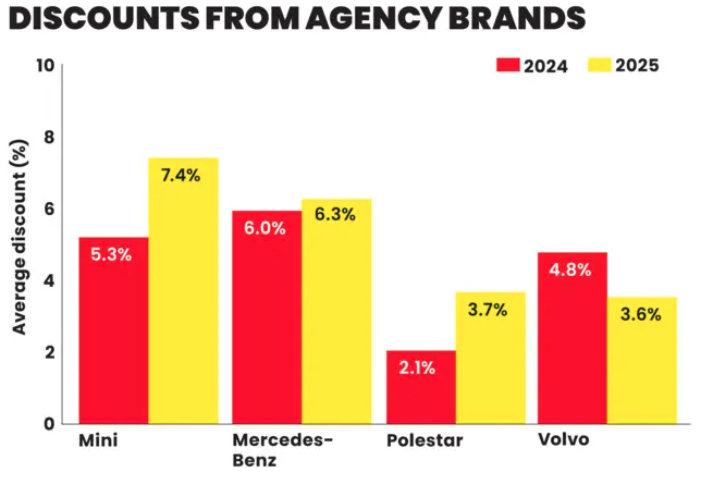

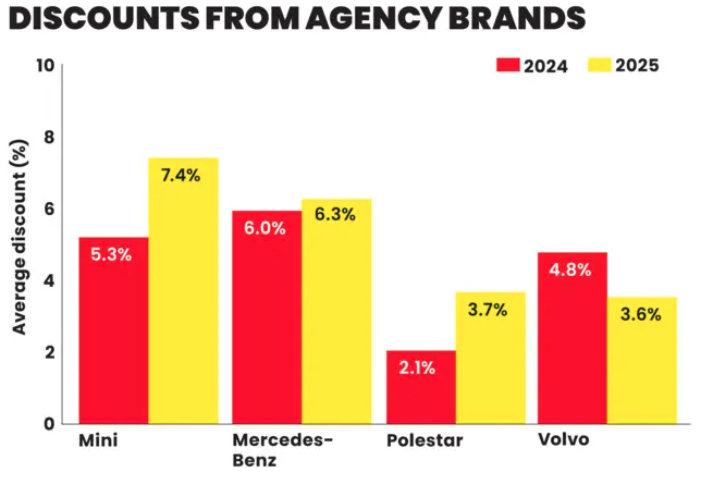

Lawless negotiates his discounts with dealers but says he can't do so with those that operate under the agency model, whereby they only display and present cars, leaving the car makers to manage sales. Here prices are non-negotiable although, depending on market conditions, they may be reduced across the dealer network.

According to Autotrader, in August last year the value of these reductions offered by the agency brands Mini, Mercedes-Benz, Polestar and Volvo averaged 4.6%. Although much lower than the discounts offered by traditional dealers, in common with the rest of the motor trade, 12 months later they had risen, albeit only to 5.3%.

What do all these discounts, reductions and offers mean for future residual values? "The best way to look at it is to compare the effective purchase price of the new car with the price of its nearly new equivalent with delivery mileage," answers Dylan Setterfield, head of forecast strategy at automotive data provider Cap HPI. "If the new car is cheaper than the used one, it's going to be extremely difficult to sell used cars at existing prices and used values will almost certainly reduce. However, in many cases, different finance deals can confuse the issue, as many buyers base their purchase decision on monthly payments, rather than the vehicle's purchase price."

Regarding EVs, Setterfield says the massive discounts on new ones are unlikely to depress the values of used ones which have already fallen a long way: "But we now have the further complication of the new government Electric Car Grant. The Ford Puma Gen-E is among the first vehicles attracting the maximum £3750 level of the grant. We have flagged it for re-forecast, as we expect that this will result in used retail values being more expensive than the new car price, although we are waiting to see whether the grant is absorbed into existing discounts."*

Peugeot 2008

Model: 1.2 Puretech Allure

Discount: 30.6% (from £29,540 to £20,490)

Nissan Qashqai

Model: 1.3 DIG-T Mild Hybrid Acenta Premium

Discount: 20.0% (from £30,615 to £24,490)

Volkswagen Golf

Model: 1.5 TSI Life

Discount: 18.7% (from £28,655 to £23,305)

Vauxhall Corsa

Model: 1.2 turbo Yes

Discount: 18.3% (from £20,560 to £16,790)

Hyundai Tucson

Model: 1.6 T-GDi Advance

Discount: 16.7% (from £33,080 to £27,549)

MG HS

Model: GS6 1.5T SE

Discount: 15.4% (from £25,995 to £21,995)

Volkswagen Tiguan

Model: 1.5 eTSI Match

Discount: 14.6% (from £37,610 to £32,110)

Nissan Juke

Model: 1.0 DIG-T Acenta Premium

Discount: 12.6% (from £23,450 to £20,495)

Ford Puma

Model: 1.0 Hybrid ST-Line

Discount: 10.3% (from £27,297 to £24,495)

Kia Sportage

Model: 1.6 T-GDi Pure

Discount: 6.8% (from £29,500 to £27,500)

How to get a discount

- Establish the vehicle's full price by configuring it online and checking for any offers and support.

- Still online, compare deals at sites including whatcar.com to gauge the discounts available.

- Armed with prices, see if local dealers can match them, making sure you visit as their sales quarters end (so in late January, late April, late July and late October).

- Visit dealers midweek, when they can give you more time, and be prepared to buy from stock for the best deal.

* prices correct as of 01 October 2025