Beyond a no-cameras showing in early March to analysts, dealers, and invited press, General Motors still hasn’t provided a first look at its next-generation electric vehicles—including the GMC Hummer EV and Cadillac Lyriq that are both due to go on sale before the end of 2021.

On the other hand, GM has been unusually open in discussing its Ultium battery and propulsion technology and the whole quite clever BEV3 architecture that underpin these new models—including the motors, battery packs, and even cells.

And as a new joint venture between GM and LG Chem, called Ultium Cells LLC, officially started clearing ground Tuesday for an Ohio battery factory that will supply the power packs for these upcoming electric vehicles, Tim Grewe, GM’s global electrification and battery systems director, was already eager to talk about what developments might arrive a few years after the plant ramps up.

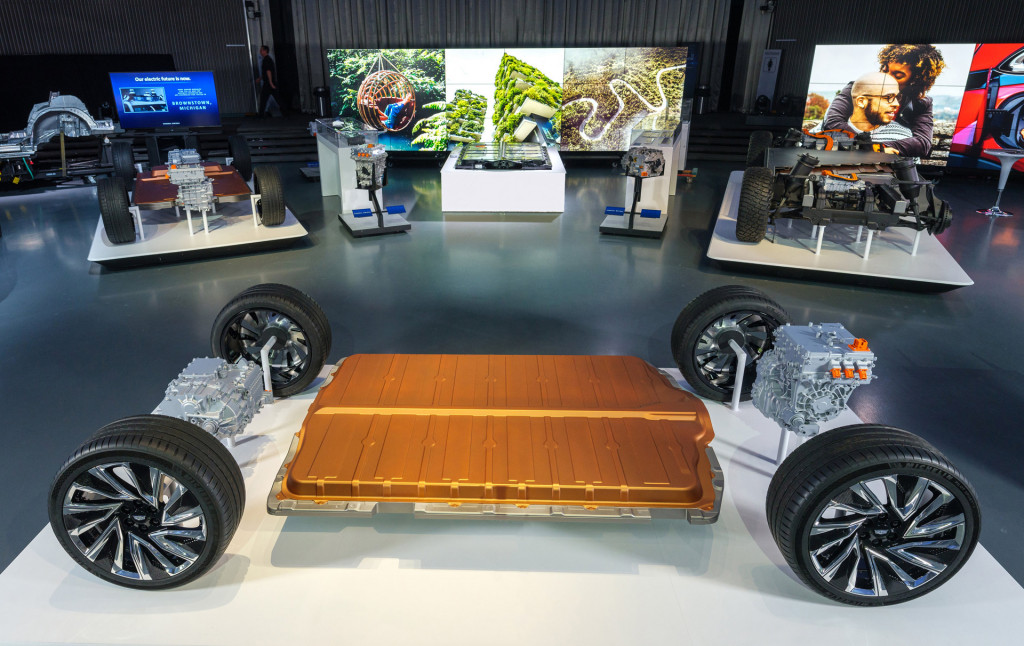

General Motors' BEV3 platform and Ultium batteries

The cells the new facility will make are large-format pouch cells, following a NCMA (nickel cobalt manganese aluminum) chemistry that was developed within GM. Compared to existing NCM cells, they’re lower in cobalt content but add aluminum to the cathode structure for longer life.

Digging deep in development

According to Grewe, even before those batteries launch, the company is already aiming for a longer service life—to be put to use in upcoming autonomous and shared-mobility vehicles like the Cruise Origin, perhaps. Zero-cobalt and zero-nickel cells are being tested, as well as with electrolyte additives and zeolite additives. “We do have million-mile battery life, especially in shared mobility usage, in our sights and are getting great results when it comes to that.”

Separator technology, different current-collector technology, over-lithiated cathodes, dry electrode processing, and anode mixes with oxides are all among the other methods the company is considering to improve fast charging while reducing costs.

And then there’s the lithium-metal cell that GM showed on its March EV Day, reporting it as in the development stages and possibly ready for production vehicles mid-decade.

“We’ve actually had a very good spring on this technology,” Grewe reported of lithium-metal. “We now see a very viable path with almost twice the energy density of today...that’ll easily enable 500-600 mile vehicles in the future."

Big cells, easy upgradability

GM’s starting point sounds well thought-out, albeit very different than the configurations chosen by Tesla or German automakers. It’s planning its next-generation vehicles around large-format cells—with a preference to pouch cells—that can be arranged horizontally or vertically into modules, with 6 to 24 modules adding up to 50 to 200 kilowatt-hours. Each cell has about the energy capacity of 20 of the cylindrical cells used by Tesla.

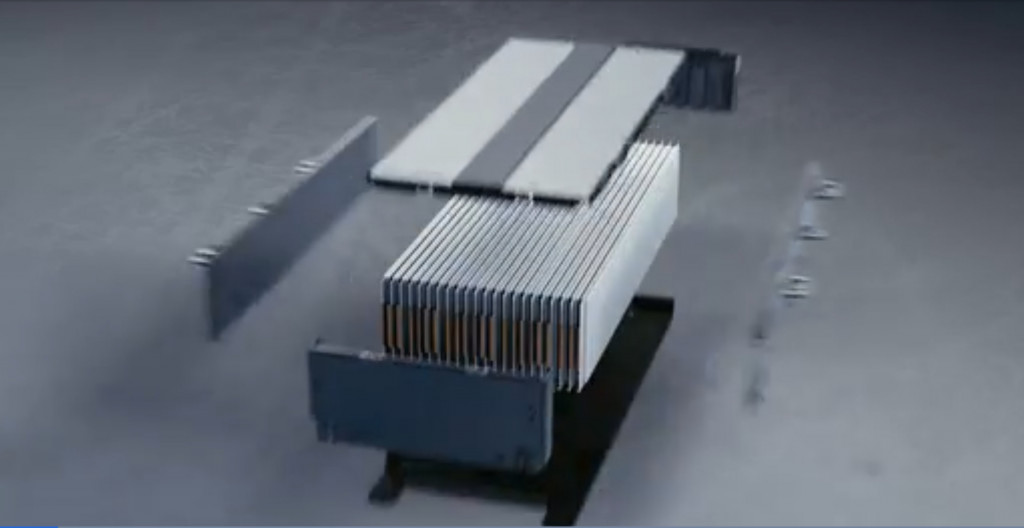

GM Ultium battery - cell stacking

Passenger cars and lower-roof vehicles will use horizontally stacked cells for lower-profile packs and modules, while trucks will be able to have vertical cell stacking—with, in some versions, a double-stacked pack that allows for 800-volt charging (and a range of around 400 miles, according to Grewe) by treating each of the 12-module layers as separate packs.

Each module will have its own battery management system, and as Grewe clarified to Green Car Reports, using the same smart wireless system for battery management. The module’s battery management system oversees the cells in that module, and then an overall architecture ties the modules together. “That wireless connection is one of our foundational flexibilities we have,” versus a traditional battery management system, said Grewe.

GM Ultium battery

The physical design of the pack and modules allow the company to easily fit future chemistry or manufacturing changes into the same format. That could help the company with pack costs down the line. GM said at its EV Day that it sees a cell cost of less than $100 per kwh—and less than $120/kwh on a pack basis—within reach.

Grewe also anticipated that “true breakthrough innovations” at the R&D stage will be here sooner than anticipated—like a volumetric energy density of a kwh per liter. “We have the confidence that we are nowhere near the bottom of the battery cost curve,” he said.

In control of the supply chain

GM sees a stable supply as being essential to reaching affordability, which could help it avoid some of the battery-supply issues that have kept a number of new electric models from Germany and South Korea from being produced in the volumes that can fully meet demand.

It’s aiming to ramp up to a million electric vehicles per year by 2025, to be split between the U.S. and China. The new joint venture will supply U.S. vehicle production and could build up to 30 gigawatt-hours annually.

That means the Ohio battery facility, which will take up the space of 30 football fields and employ 1,100, will ramp up to a quarter billion cells every year by that mid-decade milepost. It will be a stress test of GM’s plan for an “all-electric future” and—perhaps—a sign that a company that’s long been obsessed with what’s arriving this year and its sales returns this quarter, it might have learned from the past.